This post may contain affiliate links, meaning I may receive a commission if you purchase through my links. I only recommend products I have personally tested or have thoroughly researched. All opinions are my own. Please read the full disclosure for more information.

Are you trying to figure out how often to invest in stocks? Or maybe even which ones you should be investing in. If you want to avoid spending hundreds or thousands of dollars hiring a financial advisor, you might first consider these tips.

While the answer to the question “How often should I invest in stocks?” really depends on your individual risk tolerance and financial goals, I do have a few key tips that may help.

How often should I invest in stocks?

This all depends on you. Between your risk tolerance, investment strategy, and financial goals, the choice is ultimately yours. However, at a bare minimum, you will want to invest some of your regular income into your retirement account. This can help avoid market volatility during a bear market.

What I do for my Roth IRA retirement account is I have an automated deposit every other week during payday. I have half of that amount invested into the S&P 500 index and the other half I can choose to invest in whatever other stocks I choose at the time.

Since I am still paying off debt, I am only contributing about $25-50 each paycheck. While this isn’t very much, the regular contributions to my Roth IRA also help me to avoid any market volatility. So routine investments and contributions should be part of your investment strategy.

Another option you may choose, which comes with higher risk, is to invest during a bear market. This is always the best time to invest, and if you want to sell your stocks, plan to sell them during a bull market. If you impulsively sell your stocks when their prices drop, in fear that you may lose money, then you will lose money.

Stock prices will rise and fall. That is just the way the stock market works. So, if you are feeling emotional about something, whether this is fear, excitement, scarcity, or obsession, I need you to pause.

Finances and emotions are closely correlated, and if we let our emotions make our decisions for us, we are more likely to make poor decisions. So if you feel any powerful emotions when you are making a financial decision, take a step back, and reconsider why you are making the decision. If your choice is the same regardless of whether you are feeling strong emotions, then you are probably okay to follow through.

To put it simply, your long-term strategy should allow you to reach your financial goals. From short-term goals (10 years or less) to long-term goals (greater than 10 years), you should always be investing in your future.

“A dollar today will be a thousand tomorrow”

Which stocks should I include in my investment portfolio?

Every type of investment strategy should include a diversified investment portfolio. By diversifying your portfolio, you avoid a lot of market volatility.

While the stock market can yield a lot in capital gains, there isn’t much risk when your investment portfolio is built for the long term. There are, however, stocks that yield much higher returns by providing dividends, which can increase your annual return.

I recommend opening a stock investment account through SoFi Investing. You can earn a $25 bonus when you fund your account with $10 to start.

Depending on your financial goals, you may choose to purchase an individual stock, or you may opt to buy mutual funds. But what are the differences between an individual stock and mutual funds?

Individual stocks are when an investor has purchased X number of shares, and now owns a percentage of that company. So, the better that company does, the better the investor does. However, only having individual stocks in your portfolio is not usually a good idea because of how much risk is involved. If that company tanks, so do its stock prices. And in these instances, investors can lose a lot of money.

Mutual funds, however, are a good idea for any investment portfolio because there isn’t as much risk. Mutual funds consist of a variety of stocks, bonds, securities, and other types of investments. With less risk, this type of investment can benefit any long-term financial goals.

5 High-Yield Dividends to Buy (2023)

While I just mentioned that individual stocks are riskier and don’t always ride out market volatility, having some risk in an investment portfolio is beneficial. So, if you can include stocks that also yield dividends, you can take advantage of the annual return and either reinvest your dividends or cash out. If you sell your stocks though, these can be taxed as capital gains.

So be mindful of this before you determine whether or not you should cash out your dividends or reinvest them.

According to Nerd Wallet and a five-year analysis of these particular stocks, here are their top five high-yielding dividend stocks.

- Saratoga Investment Corp. – SAR(12.09%)

- Spok Holdings Inc. – SPOK (10.33%)

- Coterra Energy Inc. – CTRA (9.75%)

- Devon Energy Corp. – DVN (9.48%)

- Cal Maine Foods Inc. – CALM (9.12%)

These stocks will have higher returns than most individual stocks with much higher interest rates. This typically means more capital gains and leads to an increased annual return on your investments.

If you don’t already have a method of buying stock or other investments, I personally use both Fidelity and SoFi. SoFi is a newer trade company, but I like its platform as it is easy to use and navigate. And with SoFi, I can even schedule to buy stocks when the market reopens.

I also have a bank account through SoFi with a high-yield savings account that I use for my emergency fund (at 4.25% APY).

How do I avoid market volatility?

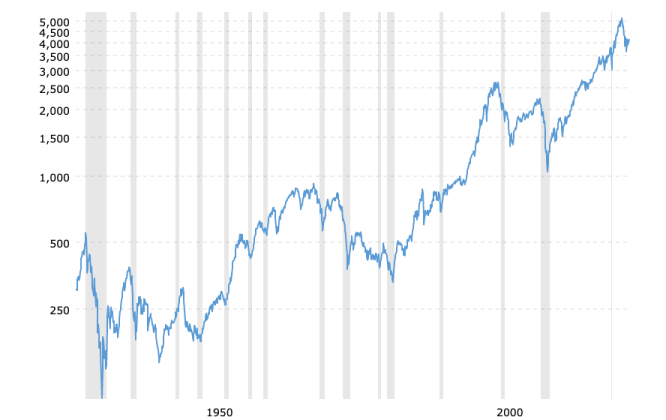

If you remember the recent stock market crash in March of 2020, nearly every one took a heavy hit to their investment portfolio. And when you look at the economy’s performance, we have seen this same thing happen during other times of recession.

So how do you avoid market volatility?

The answer is fairly simple, but determining which stocks, bonds, funds, and other investments to include in your investment portfolio all depends on your risk tolerance.

Your risk tolerance typically depends on your circumstances, but I will go into more detail on that later.

In short, diversifying your investment portfolio is the best way to avoid market volatility.

It is safest to start with less risky investments. The S&P 500 index is a fairly stable ETF (exchange-traded funds) and is one of the most common index funds included in a retirement account with good asset allocation. This ETF includes stocks from well-established companies in major areas of the economy.

And one of the best reasons why buying stock in the S&P 500 index is low risk, is that it has never had a loss over a 20-year period holding.

So, when determining which stocks to include in your investment portfolio to avoid market volatility, you will want to do a little bit of research to see the past performance of your potential investment.

For example, the S&P 500 index has not had a loss over a 20-year period. This means that this index fund is very stable and does not have much risk.

Start with less risk, and as you determine your particular investment strategy, you can better decide how much risk you can take.

You will want to research stocks that can outlast a bear market (stock prices are going down) and will thrive in a bull market (stock prices are going up).

You can do your research at Macrotrends.net, where you can track the last few years to as long as the entire lifetime of a stock, fund, bond, etc.

After doing a little bit of research, you will want to determine your risk tolerance, and what your specific investment strategy is. I will cover this in just a moment.

Lastly, you will also want to know what your financial goals are. This can be small goals like vacations, or bigger goals like buying a home or retiring before the age of 60. Determining your financial goals will have a much larger impact on your investment strategy than other factors.

So, figuring this out first can help narrow this strategy down. If you are struggling to figure out your goals, you will want to talk to your partner, family, and friends. To better understand how to have these conversations, you may want to read When Should I Talk to My Partner About Finances?

How much risk should I be taking with my investment strategy?

As previously mentioned, your financial goals will have a much larger impact on your investment strategy. So, let’s go over what some of those goals might include.

Financial goals may include…

- Making a lot of money (obviously, right)

- Buying a home

- Getting married

- Starting a family

- Going on vacations every year

- Retiring early

- Paying for your children’s college

- Buying a new car

- Buying a classic car!

- Starting a business

- Buying a boat

- Owning a vacation home

- And more!

Also, when it comes to stock investing, it’s important to understand how to manage how you are purchasing and selling so you can avoid having to pay for capital gains as long as possible. You can learn more about how to avoid paying capital gains on stocks by reading this post on Stock Fit.

Related Posts You Will Want To Read

- The Top 31 Most Valuable Books to Look For in Thrift Stores in 2024

- 21 Best Remote & Work From Home Jobs That Pay Well in 2024

- 10 ways to make money fast (some you haven’t thought of)

- When is The Best Time for Garage Sales and Yard Sale Season?

- Why You Need an Emergency Fund

- Free Budgeting Spreadsheet! – How to Easily Track Your Finances

- Why Every Student Needs to Take a Personal Finance Course

After determining your financial goals, you will need to consider your current age. Typically, the younger you are the more risk you are able to take. But as you age, your risk tolerance should involve less risk.

If you haven’t already opened a retirement account, or don’t have one established through your employer, you will want to do this as soon as possible. It is fairly easy, and you can set up automatic deposits to send money directly to your retirement account. You can also automate your investments as well if you want, to make life a bit easier.

‘Set it and forget it’

So, going back to how much risk you should be taking with your investment strategy.

The younger you are, the more risk you can afford to take. This means you can choose individual stocks that may have higher interest rates, but less stability. For example, you can choose to buy a particular stock like Amazon, Tesla, Walmart, and more.

Owning individual stocks rather than a mutual or index fund is riskier because, without a diversified investment portfolio, you are much more likely to take a bigger loss during a bear market. However, you also have a greater chance of higher returns on your investments.

But no matter your age or your risk tolerance, you should always have some of your investment portfolio designated to lower-risk investments. This can include index funds, mutual funds, bonds, and CDs. Having a least some of your portfolio designated to low-risk investments help you to avoid market volatility.

Now, if you are closer to retirement, or don’t have much income to invest but still want to contribute towards your retirement account, then you’ll want to consider the less risky options that I just mentioned. Additionally, as you start to hit milestones in your life, you may also need to reconsider your investment strategy and risk tolerance.

If you are considering retirement or aren’t sure if you are financially ready to retire, you may want to consider a financial advisor. They can help you better determine how to adjust your investment strategy and whether or not you are financially ready to retire.

A financial advisor can also provide you with investment advice to help you reach your long-term goals. So, regardless of your financial needs, you will have options when it comes to your investment strategy.

Related Articles

- 23 Reliable Ways to Make $300 or More a Day

- 27 Best Online Tutoring Jobs to Make Money at Home in 2024

- Why Every Student Needs to Take a Personal Finance Course

- Easy Beginner Finance tips for people in their 20’s